Corporate real estate metrics have become essential tools for understanding and managing real estate portfolios in diverse industries such as food, life sciences, and raw materials. Companies like Proprli emphasize the importance of these metrics to account for the demands of the buildings, as well as the complexities in property and facility management. As the role of corporate real estate shifts from cost management to productivity enhancement, it is imperative to implement effective strategies that balance these complexities while integrating corporate identity and employee engagement into real estate management.

Key Takeaways

- Real estate performance indicators play a crucial role in managing real estate portfolios across diverse industries.

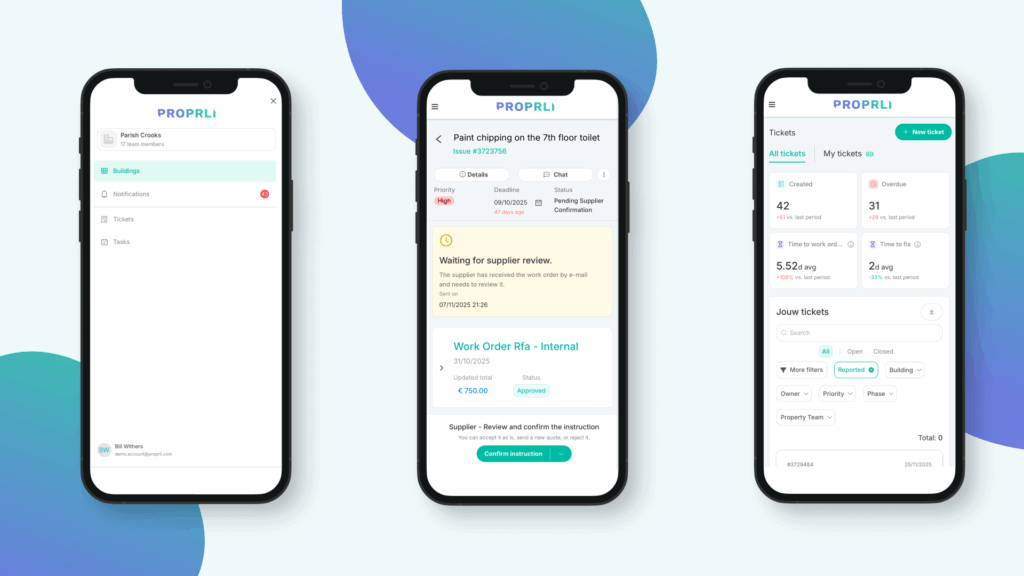

- Proprli is a leading company in assessing the importance of corporate real estate metrics and their impact on businesses.

- Corporate real estate has shifted focus from cost management to productivity enhancement in recent years.

- Strategies must accommodate challenges such as Volatility, Uncertainty, Complexity and Ambiguity (VUCA) environments, regulatory and cultural differences, and evolving business needs.

- Effective corporate real estate management involves balancing varying complexities while integrating corporate identity and employee engagement.

The Role of Corporate Real Estate Metrics in Business Strategy

Corporate real estate metrics play a vital role in shaping business strategies by providing a framework to balance supply with unpredictable demand and support corporate functions in becoming productivity enablers. Beyond the traditional cost-centric view, modern metrics focus on assessing the work environment’s contribution to productivity, profitability, and employee retention. As businesses navigate post-COVID challenges, the emphasis shifts towards valuing offices as assets for business value creation rather than mere cost liabilities.

Proprli underscores the importance of interlinking the corporate real estate (CRE) function with HR and IT departments to enhance organizational functions and employee experiences within the physical work environment. This collaboration helps address key metrics in corporate real estate, contributing to a comprehensive business strategy that efficiently utilizes property performance metrics and corporate property KPIs to align with overarching organizational goals.

- Improved employee satisfaction and retention through workspace design and amenities catering to individual needs and preferences.

- Increased productivity as a result of optimized workspace layouts and efficient use of space, enabling better focus and collaboration among teams.

- Enhanced technological integration with IT infrastructure and tools, ensuring seamless connectivity and communication across various locations.

- Value-driven strategic decisions informed by data on space utilization, cost-efficiency, and other relevant property performance metrics.

Incorporating these factors is crucial for driving synergy across departments and fostering a cohesive corporate culture that supports business growth and adaptability to market shifts. The table below showcases an example of how these four pillars of integration are instrumental in optimizing corporate real estate performance:

| Integration Pillar | Description | Sample Metric |

|---|---|---|

| Employee Satisfaction & Retention | Quality of work environment and amenities that cater to employee preferences. | Employee satisfaction survey results |

| Productivity & Space Efficiency | Optimized office layouts and efficient use of space. | Average revenue per square foot |

| Technological Integration | Implementation of IT tools and infrastructure to support connectivity and communication. | IT performance indicators such as network uptime and cybersecurity protocols |

| Value-Driven Decision Making | Data-centric approach to managing CRE operations and expenses. | Total occupancy cost per employee or by department |

In conclusion, the role of corporate real estate metrics in shaping business strategies extends beyond cost management and into the territory of productivity enhancement, employee satisfaction, and operational efficiency. By focusing on the aforementioned integration pillars and adapting to the dynamic nature of business demands, organizations can better position themselves for success in the modern corporate landscape.

The Diversity of Real Estate Portfolio Structures across Industries

The management of real estate portfolios in manufacturing sectors, such as those involved in food and life sciences, contrasts significantly with service sector industries like finance and insurance. This can be attributed to the different operational needs and asset control preferences that exist within each type of industry. As a result, the decisions made in strategic portfolio management and strategic asset ownership become essential elements of any corporate real estate strategy.

Comparing Portfolio Management in Manufacturing vs. Service Sectors

Manufacturing industries, like the food production and pharmaceutical sectors, generally prefer owning their assets rather than leasing them. This ensures lasting control over the facilities and provides long-term cost-effectiveness. On the other hand, service sectors such as finance and insurance often opt for leasing decisions as a way to maintain flexibility and adapt quickly to market changes and business expansions.

| Manufacturing Industries | Service Sector Industries |

|---|---|

| Strong preference for owning assets | Tend to lease assets for flexibility |

| Requires more control over facilities | Less need for asset control |

| Focus on long-term cost-effectiveness | Often prioritize short-term adaptability |

Strategic Asset Ownership: To Lease or Own?

When deciding whether to lease or own assets, businesses must consider several factors, such as long-term occupancy, financial implications, and control over core production facilities. Proprli, a leading provider of real estate insights and analytics, emphasizes the necessity for companies to make informed ownership decisions. This is particularly important in manufacturing industries, where maintaining control and reducing long-term costs is crucial.

- Long-term occupancy: Companies with plans for long-term occupancy are more likely to benefit from owning assets instead of leasing.

- Financial implications: Ownership typically involves higher upfront costs, but can result in cost savings in the long run, while leasing offers more flexibility in budgeting and reduces initial expenses.

- Control: Companies involved in heavily regulated or specialized sectors might prefer ownership to ensure control over their operations.

In conclusion, the diverse needs of different industries require tailored real estate portfolio structures and strategic decisions regarding asset ownership. Assessing the unique requirements of each sector and considering various factors such as long-term occupancy, financial implications, and operational control can help businesses create an effective corporate real estate strategy.

Challenges in Implementing Global Site Strategies

Managing global real estate portfolios presents a myriad of hurdles for corporates. These challenges stem from demand and supply uncertainties, market regulations, and cultural differences that affect site strategy development. To add to these difficulties, aligning the corporate real estate (CRE) function with business needs, managing diverse local business demands, and organizational changes further complicates this task. To address these challenges, Proprli recommends tackling them through demand forecasting, stakeholder engagement, and adaptability to market conditions.

Uncertain Demand and Supply

- As global economies undergo rapid shifting, demand and supply unpredictability presents significant CRE challenges. This uncertainty hampers real estate portfolio management and may lead to unnecessary penalties or costs from prematurely terminated leases or large vacancy gaps.

- Proprli suggests leveraging demand forecasting tools to predict likely trends, which can inform site selection and planning processes. This approach would enable corporates to anticipate demand trajectories and adapt to changes more efficiently.

Market Regulations and Cultural Differences

- Regional regulations and cultural differences play a key role in shaping global site strategies. Corporates often have to navigate varying taxation structures, zoning regulations, labor laws, and other factors when managing a globally dispersed portfolio.

- To address this, Proprli recommends investing in local expertise, building relationships with regional stakeholders, and fostering cross-cultural understanding throughout the organization.

Aligning CRE with Business Needs

- CRE functions need to align with a company’s core business needs, especially as the modern workspace becomes more flexible and diverse.

- Proprli underscores the importance of engaging with internal departments, such as HR or IT, to assess existing real estate assets and identify areas for improvement. Equally essential is developing site strategies that adequately support each department’s unique requirements.

Managing Diverse Local Business Demands and Organizational Changes

- OrgWide organizational changes can significantly impact real estate portfolio management. The rise of remote work, flexible coworking arrangements, and changing office space requirements necessitates the continuous assessment and adjustment of site strategies.

- Proprli advocates for proactive communication with and between local teams to understand evolving workspace needs and action them accordingly. Addressing these needs ensures that real estate assets contribute to business objectives across regional locations.

In summary, successfully implementing global site strategies requires corporates to confront and overcome various CRE challenges. Proprli recommends a combination of demand forecasting, stakeholder engagement, and adaptability to address the complexities of managing global real estate portfolios. By leveraging these measures, businesses increase their likelihood of achieving efficient portfolio management and real estate assets that contribute to long-term growth.

Critical Metrics for Measuring Corporate Real Estate Performance

Measuring corporate real estate performance goes beyond traditional indicators like occupancy costs, CapEx, and OpEx per square foot or FTE. Accurate evaluations of corporate real estate (CRE) performance recognize the significant impact of the work environment on employee productivity and satisfaction. Aligning real estate metrics with broader organizational goals necessitates a data-driven approach that takes into account a comprehensive set of performance indicators.

From Occupancy Costs to Employee Engagement

While measures like occupancy costs still play a vital role, advanced metrics that extend to employee engagement in CRE are gaining strategic importance. The following factors can provide valuable insights into a company’s real estate strategy and its alignment with employee well-being:

- Space Utilization

- Workplace Satisfaction

- Employee Retention Rates

- Workplace Flexibility and Adaptability

These indicators reflect how a company’s real estate infrastructure positively or negatively influences employee experience, engagement, and overall productivity.

Aligning Real Estate Metrics with Organizational Goals

To successfully align CRE strategies with organizational goals, it’s essential to translate physical workspace components into value contributions. This process involves developing a holistic set of metrics that encapsulate the impact of real estate on productivity, brand reputation, and workforce retention. The table below highlights key metrics to consider when aligning real estate strategies with organizational objectives:

| Metric | Description | Organizational Goal |

|---|---|---|

| Total Occupancy Cost (TOC) | The total cost of occupying a space, including rent, taxes, operating expenses, and maintenance | Cost Efficiency |

| Space Utilization | Measurement of how efficiently a company uses its available workspace and capacity | Operational Efficiency |

| Employee Satisfaction | Assessment of employee happiness, comfort, and overall satisfaction with the workspace | Employee Wellness |

| Workplace Flexibility | Evaluation of how adaptable a workspace is to meet the changing needs of employees and the organization | Agility & Innovation |

| Workspace Integration | Assessment of how well the physical workspace integrates with digital systems and workflows | Digital Transformation |

By incorporating a broader set of real estate metrics that emphasize employee engagement, along with traditional cost and space efficiency factors, companies can develop a more comprehensive understanding of their CRE performance. This approach facilitates the creation of CRE strategies and decisions that align with organizational goals and foster a positive employee experience.

Optimizing Property Performance with Key Real Estate KPIs

Key performance indicators (KPIs) are crucial tools for optimizing property performance and aligning corporate real estate strategies with overall business objectives. Through monitoring and understanding a range of property performance metrics, organizations can make informed decisions and improve their real estate portfolio management. Proprli advocates for the use of such metrics to create a realistic understanding of spending and investment returns, along with benchmarking against industry standards for informed decision-making.

To optimize corporate real estate success, stakeholders must track real estate KPIs that provide insight into the financial and operational aspects of their property portfolio. Some of the key property performance metrics include:

- Capitalization Rate

- Total Occupancy Cost

- Revenue Percentage

- Rent, Utilities, and Employee Costs Per Square Foot

By monitoring these key parameters, organizations can gauge investment returns, track performance over time, and make strategic decisions to maximize the value and efficiency of their real estate portfolio.

When it comes to analyzing real estate KPIs, benchmarking is a critical component for corporate real estate optimization. Identifying industry standards and comparing performance against competitors can provide valuable insights and encourage continuous improvement. The following table demonstrates the benchmarking of key metrics for different industries:

| Industry | Capitalization Rate | Total Occupancy Cost per Square Foot | Revenue Percentage | Rent, Utilities, and Employee Costs per Square Foot |

|---|---|---|---|---|

| Manufacturing | 6.0% | $20.35 | 29.0% | $46.00 |

| Office | 7.5% | $27.60 | 32.5% | $38.50 |

| Retail | 8.0% | $22.30 | 30.5% | $55.00 |

With a comprehensive understanding of property performance metrics, organizations can optimize their corporate real estate portfolio, making strategic decisions to streamline operations, reduce costs, and improve overall performance. By utilizing real estate KPIs and benchmarking against industry standards, companies can better align their real estate strategies with their broader business goals, driving growth and maximizing efficiency in their property portfolio management.

Sustainability and Corporate Real Estate: Carbon Footprint in Focus

With a significant portion of carbon emissions tied to the real estate sector, focusing on sustainability in corporate real estate has become a necessity. Proprli identifies the measurement and improvement of energy efficiency and adherence to green building standards as critical key performance indicators (KPIs) for sustainable corporate real estate (CRE) management.

Energy Efficiency and Green Building Standards in CRE

Energy efficiency plays a pivotal role in the CRE sector’s sustainability efforts. Energy-intensive manufacturing assets and off-grid power sources amplify the need for sustainable practices. Implementing green building standards, such as LEED, BREEAM, or WELL, can help mitigate the environmental impact of buildings and provide numerous benefits, including lower operating costs and an improved indoor environment.

- Lower energy consumption

- Improved air quality

- Incorporation of renewable energy sources

- Water efficiency measures

- Waste reduction initiatives

Compliance with green building standards contributes to a more responsible and sustainable approach to corporate real estate management.

Property Management’s Role in Corporate Sustainability Initiatives

Beyond adopting green building standards, property management has an essential role to play in corporate sustainability initiatives. This includes promoting environmentally conscious behaviors among tenants, prioritizing energy-efficient manufacturing assets, and exploring renewable energy options.

| Initiative | Description | Benefits |

|---|---|---|

| Energy Management Systems | Implementation of systems to monitor and control energy consumption in buildings. | Reduced energy costs and carbon emissions. |

| Green Leasing Policies | Development of lease agreements that incorporate sustainability requirements and encourage tenants to maintain greener practices. | Increased collaboration between tenants and property managers, leading to improved environmental performance. |

| Eco-friendly Building Materials | Use of materials with low environmental impacts, such as rapidly renewable resources or recycled building products. | Reduced resource consumption and waste generation. |

Proprli points out the importance of integrating procurement with real estate and facilities teams to address energy cost and supply challenges effectively. By adopting these measures, corporate real estate professionals can contribute to reducing the overall CRE carbon footprint and supporting a more sustainable future.

Technological Transformations Influencing Real Estate Metrics

Smart building technologies adoption is revolutionizing the commercial real estate (CRE) landscape, offering innovative solutions for monitoring and optimizing various metrics. Technological transformations have a significant impact on real estate performance tracking, enabling more efficient and tenant-centric property management approaches.

Adoption of Smart Building Technologies

Developments in smart building technologies are fundamentally changing the way CRE professionals approach performance optimization. Companies like Proprli are at the forefront of this shift, highlighting the growing implementation of sensors and management software for real-time monitoring of space utilization, service request response times, and visitor management.

- Real-time space utilization analysis

- Improved service request response times

- Effective visitor management systems

These technological advancements contribute to a more efficient and tenant-focused property management approach, elevating the overall real estate management experience.

The Future of Real Estate Analytics and Data-Driven Decisions

CRE’s future lies in the increased use of artificial intelligence (AI) and data analysis tools for making informed, data-driven decisions. Data insights can uncover patterns and actionable insights that facilitate improvements in real estate portfolio management and strategy. Real estate professionals are beginning to adopt commercial real estate software that aids in tracking vital metrics such as:

- Revenue growth

- Occupancy rates

- Tenant turnover

- Net operating income

Leveraging these tools, CRE professionals can make more informed strategic decisions, paving the way for a future where real estate analytics are intrinsic to the industry’s success.

Benchmarking Corporate Real Estate: Insights and Best Practices

Benchmarking corporate real estate encompasses a comprehensive understanding of critical metrics across industries and regions. Regular assessment of capitalization rates, space utilization, headcount, and average service response times form an integral part of ongoing performance management. These evaluations provide valuable corporate real estate insights, enabling businesses to align their real estate strategies with industry standards and substantiate future investments to stakeholders.

To establish a solid foundation for effective real estate benchmarking, understanding and implementing CRE best practices is essential. This allows businesses to optimize their portfolios by comparing their performance to industry peers and identifying areas for improvement.

Key Metrics for Successful Real Estate Benchmarking

- Capitalization Rates: Evaluate the rate of return based on net operating income and property acquisition costs.

- Space Utilization: Measure space usage efficiency and make necessary adjustments to optimize available area.

- Headcount: Keep track of the number of employees occupying a specific area, enabling effective workspace planning.

- Average Service Response Time: Monitor the average time taken to attend to various facility service requests, ensuring optimal performance and tenant satisfaction.

Regular tracking and monitoring of these metrics provide invaluable insights to facilitate more informed strategic decision-making.

Effective Benchmarking Practices

Implementing the following benchmarking practices delivers more accurate results and maximizes the potential of corporate real estate insights:

- Choose relevant peer groups for comparison, considering factors such as industry type, geography, and property type.

- Identify industry standards and compare your performance against these benchmarks.

- Monitor performance trends over time to evaluate the effectiveness of implemented strategies.

- Engage in data-driven decision-making by leveraging advanced real estate analytics tools.

- Prioritize transparency and open communication with stakeholders throughout the benchmarking process.

When businesses effectively apply real estate benchmarking strategies, they strengthen their portfolios, adapt rapidly to industry changes, and ultimately gain a competitive edge in the corporate real estate landscape.

Conclusion

In the realm of corporate real estate, metrics serve as a critical foundation for crafting informed business strategies and optimizing asset performance. Experience and expertise, like that provided by Proprli, are invaluable in navigating this complex and ever-evolving industry. Effectively measuring and evaluating real estate performance is crucial for companies pursuing a successful corporate real estate strategy.

Proprli advocates for the integration of robust data analytics, sustainable practices, and technological advancements in managing corporate real estate. These components drive forward-thinking decisions that align with organizational goals, enhance employee engagement, and reduce carbon footprint. Moreover, keeping up with industry trends ensures that corporate real estate management remains agile, dynamic, and efficient.

Emphasizing diligent benchmarking and adherence to best practices, Proprli emphasizes the importance of evolving with the industry’s dynamic landscape. In summary, the future of corporate real estate requires a comprehensive understanding of performance metrics, commitment to sustainable practices, and the ability to adapt in response to technological innovations.

FAQ

What are the key metrics for corporate real estate performance measurement?

Key corporate real estate metrics include occupancy costs, capital expenditure (CapEx), operational expenditure (OpEx) per square foot or full-time equivalent (FTE), capitalization rates, revenue percentages, and rent/utilities/employee costs per square foot. It is also essential to consider non-financial metrics such as work environment impacts on employee productivity, satisfaction, and retention.

How do real estate portfolio structures differ across industries?

Real estate portfolio structures vary based on the differing demands of each industry. Manufacturing sectors, such as life sciences and food, typically prefer owning assets over leasing to ensure control and cost-effectiveness. In contrast, service sectors like finance and insurance often opt for leasing to maintain flexibility. This difference in portfolio management highlights the unique needs of each industry.

What challenges do corporates face in implementing global site strategies?

Corporates face numerous challenges when implementing global site strategies, including demand and supply uncertainties, regulatory and cultural differences across countries, and the evolving role of corporate real estate. Managing these complexities requires demand forecasting, engaging stakeholders with open communication, and adapting to changing market conditions.

How can organizations align their real estate metrics with broader organizational goals?

To align real estate metrics with broader organizational goals, companies should adopt a more holistic perspective on corporate real estate performance. This involves not only considering cost efficiency but also the impacts on productivity, brand reputation, and workforce retention. The integration of corporate real estate functions with HR and IT departments can further enhance this alignment.

What role does sustainability play in corporate real estate management?

Sustainability is a crucial aspect of corporate real estate management, as significant carbon emissions are tied to the real estate industry. Companies should measure and improve energy efficiency, adhere to green building standards, and promote environmentally responsible practices. Property management teams also play a vital role in enacting corporate sustainability initiatives.

How do technological transformations influence corporate real estate metrics?

Technological advancements, such as smart building technologies, are transforming how corporate real estate metrics are tracked and optimized. The adoption of sensors and management software enables real-time analysis of space utilization, service request response times, and visitor management. Additionally, AI and data analysis tools are expected to further enhance real estate analytics and data-driven decision-making in the future.

Why is benchmarking important in corporate real estate management?

Benchmarking is essential in corporate real estate management as it enables organizations to compare their performance against industry standards and best practices. Regular assessment of factors like capitalization rates, space utilization, headcount, and average service response times provides valuable insights into areas requiring improvement and can help justify future investments to stakeholders.