The Corporate Sustainability Reporting Directive (CSRD) is set to transform the real estate industry by 2025. Adopted by the European Union in 2022, it broadens the scope and standards for corporate sustainability reporting. With about 50,000 companies now under its watch, compared to just 11,000 under the previous Non-Financial Reporting Directive (NFRD), the CSRD promises unprecedented transparency and comparability in the real estate sector’s ESG performance.

Real estate companies face significant challenges as they adapt to the CSRD. They must employ advanced data analysis and housing market analysis to comply with the new standards. Real estate data visualization will be key in communicating ESG efforts and progress to various stakeholders. The CSRD’s focus on detailed, standardized reporting will not only foster positive change but also enable consumers to make better-informed decisions about property transactions.

Key Takeaways

- The CSRD will affect around 50,000 companies, significantly expanding sustainability reporting requirements

- Real estate firms must leverage data analysis and visualization to meet CSRD standards

- Transparency and comparability of ESG performance will be crucial for real estate companies

- The CSRD will drive positive change in the industry and empower consumers to make informed decisions

- Real estate companies must start preparing now to ensure compliance and maintain a competitive edge

What is CSRD and how does it affect real estate companies?

The Corporate Sustainability Reporting Directive (CSRD) is a new regulation aiming to boost transparency and accountability in the European Union. It focuses on environmental, social, and governance (ESG) performance. Real estate companies will be significantly impacted, needing to disclose detailed information on their sustainability efforts. They must align with the European Sustainability Reporting Standards (ESRS).

The CSRD will be rolled out in phases, based on company size and type:

| Year | Companies Affected |

|---|---|

| 2024 | Large companies already subject to the NFRD |

| 2025 | All other large European companies and certain international groups |

| 2026 | SMEs listed on European markets |

| 2028 | Large non-European companies with significant operations in Europe |

Real estate companies must thoroughly review their real estate investment strategy to comply with the CSRD. They need to integrate ESG factors into their decision-making. This might involve using real estate analytics to evaluate property sustainability and pinpoint areas for betterment.

The CSRD’s thematic scope is broad, covering ESG issues like energy efficiency, greenhouse gas emissions, and social impact. Real estate firms must gather and report data on these topics. They also need to show how they’re tackling sustainability challenges and aiding the shift to a low-carbon economy.

By adopting the CSRD and integrating ESG into their operations, real estate companies can fulfill regulatory demands. They can also improve their reputation, draw in eco-conscious investors, and support a sustainable future for the built environment.

Why property and asset managers must act now

Property and asset managers must prepare for CSRD compliance well before the deadline. Taking proactive steps today can prevent unnecessary stress and ensure a smooth reporting process. It’s essential to conduct thorough real estate market research and analyze property market trends. This helps identify gaps in current practices and data collection methods.

To get started, property and asset managers should:

- Map out their portfolio and determine reporting boundaries

- Engage with companies to initiate materiality assessments

- Begin comprehensive data collection across all relevant metrics

- Invest in a sustainability platform to streamline processes

Early preparation gives ample time to address any issues and ensure accurate, complete data. By showing a commitment to sustainability through CSRD compliance, managers can build trust with stakeholders. This positions them as leaders in the industry.

Acting now is wise from a compliance standpoint and beneficial for long-term success. Strong reporting processes and a focus on sustainability can open new opportunities in the evolving real estate market. Staying ahead of property market trends and integrating ESG principles into decision-making will be key differentiators in the years to come.

5 steps to comply with CSRD with minimal stress

The Corporate Sustainability Reporting Directive (CSRD) is approaching, and real estate managers must prepare. By following these five steps, you can achieve CSRD compliance for your real estate portfolio with minimal stress:

- Understand the boundaries for CSRD reporting by identifying companies under your financial or operational control and gathering baseline data.

- Conduct materiality assessments at the portfolio level, considering both impact and financial materiality.

- Build strong relationships with portfolio companies to streamline data collection.

- Use technology to simplify CSRD compliance, such as sustainability management platforms that centralize data collection, analyze ESG performance, and prepare consolidated reports.

- Start preparing early to identify gaps in processes and ensure comprehensive and accurate data.

To effectively navigate CSRD for real estate, it’s crucial to establish a clear understanding of the reporting boundaries. This involves identifying the companies within your portfolio that fall under your financial or operational control and collecting baseline data to assess their current sustainability performance.

Conducting materiality assessments at the portfolio level is another key step in the process. These assessments should take into account both the impact and financial materiality of sustainability issues, allowing you to prioritize your efforts and resources.

Collaborating closely with your portfolio companies is essential for streamlining data collection and ensuring the accuracy of your CSRD reporting. By building strong relationships and establishing clear communication channels, you can more easily gather the necessary information and address any challenges that arise.

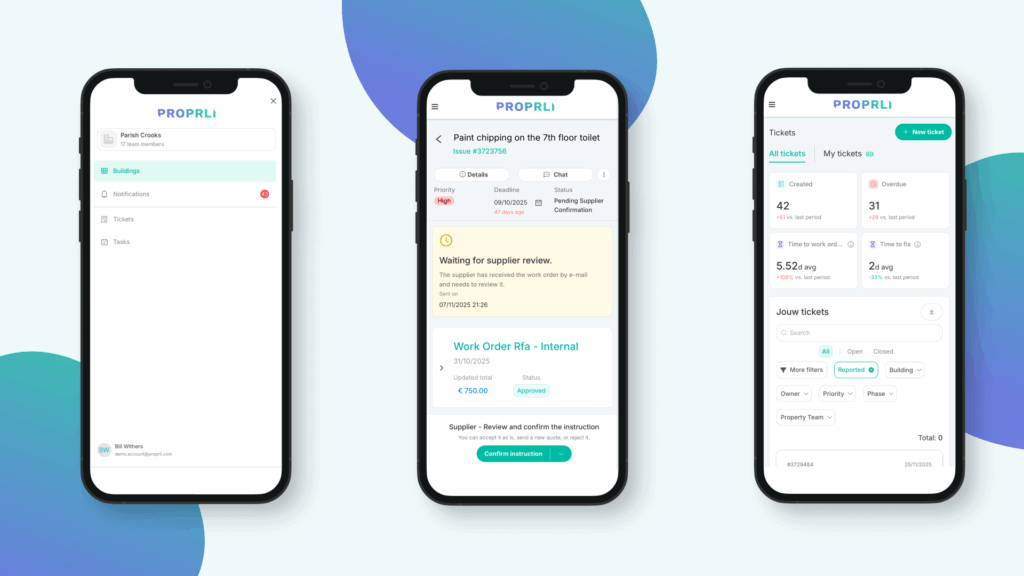

Leveraging technology can greatly simplify the CSRD compliance process for real estate companies. Sustainability management platforms, for example, can centralize data collection, analyze ESG performance, and generate consolidated reports, saving you time and resources.

Lastly, starting your CSRD preparations early is crucial for identifying any gaps in your processes and ensuring that you have comprehensive and accurate data. By taking a proactive approach, you can minimize stress and ensure a smooth transition to CSRD compliance.

Common mistakes in CSRD preparation (and how to avoid them)

As property and asset managers prepare for the Corporate Sustainability Reporting Directive (CSRD), it’s crucial to be aware of common pitfalls. One frequent mistake is not starting the preparation process early enough. This leaves insufficient time for thorough data collection and analysis. Failing to engage with portfolio companies and gather the necessary information can also lead to incomplete or inaccurate reporting.

To avoid these missteps, it’s essential to assemble a dedicated CSRD task force. This team should have expertise in finance, environment, governance, and sustainability. They should develop and prepare a double materiality analysis to identify the most significant sustainability risks and opportunities. Gaining a comprehensive understanding of the European Sustainability Reporting Standards (ESRS) is also crucial to ensure compliance.

Another common mistake is not leveraging technology to streamline the real estate data analysis process. Collecting and monitoring reliable data is a critical component of CSRD preparation. Utilizing the right tools can make this task more efficient and accurate. Property and asset managers should invest in software solutions that facilitate data collection, validation, and reporting.

When drafting the CSRD report, it’s important to use a format that complies with the reporting standards. Failing to adhere to these guidelines can result in non-compliance and potential penalties. To avoid this, managers should carefully review the ESRS requirements and seek guidance from sustainability reporting experts if needed.

By following these steps and avoiding common pitfalls, property and asset managers can navigate the CSRD preparation process with minimal stress. They can ensure a successful transition to the new sustainability reporting framework.

Looking ahead: how CSRD fits into your long-term ESG strategy

Complying with the Corporate Sustainability Reporting Directive (CSRD) is more than just a regulatory requirement. It’s a chance to integrate your real estate investment strategy with long-term ESG goals. By adopting the CSRD, you enhance transparency, bolster your portfolio’s resilience, and emerge as a pioneer in sustainable investing.

To confidently meet CSRD standards, first grasp your reporting scope and conduct detailed materiality assessments. This step is crucial for pinpointing the ESG aspects most pertinent to your operations and stakeholders. Utilizing technology can also simplify data gathering and reporting, easing the compliance burden.

The CSRD transcends mere compliance; it serves as a catalyst for a robust ESG strategy. Embarking on this path today secures your real estate investment strategy for the future. It prepares you for the evolving sustainable investing landscape. Adopting the CSRD showcases your dedication to a sustainable, resilient future for the real estate sector.

FAQ

What is the Corporate Sustainability Reporting Directive (CSRD)?

The Corporate Sustainability Reporting Directive (CSRD) is a European directive from 2022. It aims to enhance corporate sustainability reporting. It replaces the Non-Financial Reporting Directive (NFRD) of 2014. Now, companies must publish detailed information on their environmental, social, and governance (ESG) performance.

How many companies will be affected by the CSRD?

About 50,000 companies will be impacted by the CSRD. This is a significant increase from the 11,000 under the NFRD.

What is the purpose of the CSRD?

The directive aims to increase transparency. It also makes it easier to compare non-financial data across Europe.

When will the CSRD be implemented?

The CSRD will be rolled out in phases. It starts with large companies already under the NFRD in 2024. Then, all large European companies and certain international groups will follow in 2025. SMEs listed on European markets will be included in 2026. Lastly, large non-European companies with significant operations in Europe will comply in 2028.

What is the thematic scope of the CSRD?

The CSRD focuses on the environment, social aspects, and governance (ESG). The expected information will be outlined in the European Sustainability Reporting Standards (ESRS). These standards are developed by the European Financial Reporting Advisory Group (EFRAG).

Why should property and asset managers start preparing for CSRD compliance early?

Early preparation helps identify gaps in processes. It ensures data is comprehensive and accurate. Managers should map their portfolio, determine reporting boundaries, and engage with companies. They should also invest in a sustainability platform to streamline processes.

What are the key steps for property and asset managers to prepare for CSRD compliance?

The five key steps are: 1) Understand the boundaries for CSRD reporting; 2) Conduct materiality assessments at the portfolio level; 3) Build strong relationships with portfolio companies; 4) Use technology to simplify CSRD compliance; 5) Start preparing early to identify gaps in processes and ensure comprehensive and accurate data.

What are some common mistakes in CSRD preparation?

Common mistakes include not starting early enough, failing to engage with portfolio companies, and not leveraging technology to streamline processes.

How can property and asset managers benefit from CSRD compliance beyond meeting regulatory demands?

CSRD compliance allows managers to align investments with long-term ESG goals. It drives transparency and strengthens portfolio resilience. It positions managers as leaders in sustainable investing, preparing them for the future of real estate.

What role does real estate data analysis play in CSRD compliance?

Real estate data analysis is crucial for CSRD compliance. It helps managers understand their portfolio’s ESG performance. By using analytics and data visualization tools, managers can efficiently collect and report sustainability data.

How can understanding property market trends and conducting housing market analysis support CSRD compliance efforts?

Understanding market trends and conducting analysis helps identify sustainability risks and opportunities. This knowledge informs investment strategies, ensuring alignment with CSRD’s ESG requirements. It contributes to sustainable and resilient real estate markets.