The digitization of real estate investment marks a significant shift. It introduces technology as the backbone of every investment method. Tools such as AI-enhanced automated valuation models and generative AI revolutionize and speed up the valuation process. By integrating data from various sources, these technologies simplify tasks for property managers.

Data platforms of high quality empower real estate experts. They enable precise predictions of market trends and the adaptation of strategies. This precision aids in making informed asset and portfolio management decisions. Thus, property managers gain enhanced capability to steer through the market with increased assurance.

Key Takeaways

- The digital evolution in real estate enhances every investment process.

- AI-enhanced automated valuation models and generative AI expedite valuations.

- Integration of diverse data streams streamlines operations for property managers.

- High-quality data platforms enable accurate market trend predictions.

- Optimized asset and portfolio management decisions become more achievable.

The Digital Revolution in Real Estate Investment

The digital revolution has fundamentally changed the way we invest in real estate. It brings an extraordinary level of efficiency and rapidity to property management. This shift is mainly propelled by sophisticated analytics and comprehensive data integration. These advancements allow for nuanced decision-making.

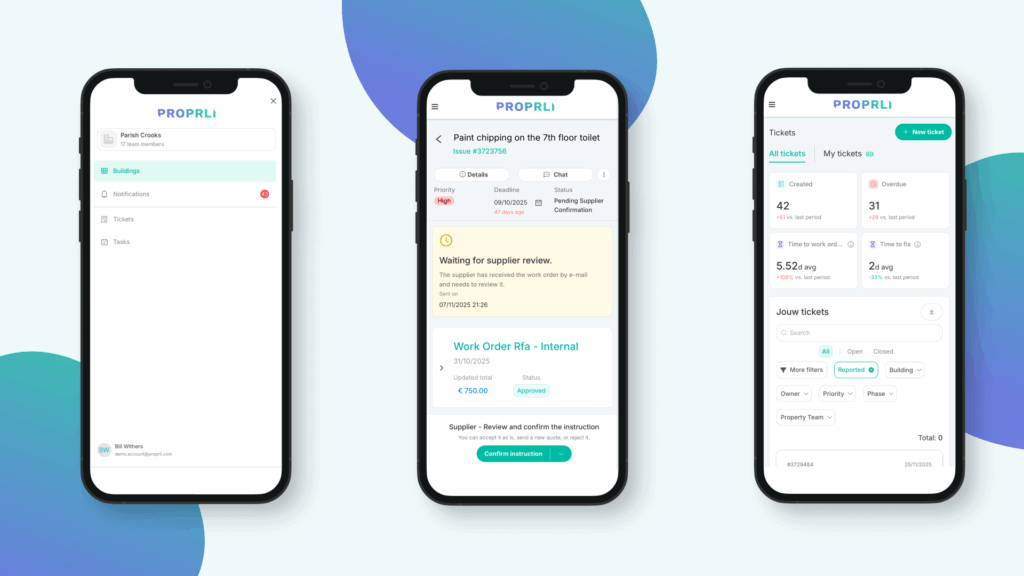

How Technology is Transforming Property Management

Integrating technology has radically altered property management. It utilizes platforms that swiftly and precisely sift through extensive data sets. Now, property managers can forecast market movements and adapt to demand shifts more adeptly. This transition embodies the industry’s move towards technology-centric operations.

Benefits of Real Estate Data Platforms

Real estate data platforms stand out for their ability to synthesize and interrogate information from varied sources, providing insights in real time. They enable a deeper grasp of market shifts, helping property management to proactively adjust. This use of technology optimizes strategies, enhances performance, and leads to superior financial results.

- Enhanced decision-making through accurate data analysis

- Improved operational efficiency with automated tools

- Greater agility in responding to market trends

Role of AI in Property Valuation

The evolution of the real estate sector highlights the growing importance of AI in property valuation. Traditional valuation methods are now being enhanced by AI-powered models. These offer better accuracy and efficiency.

Leveraging AI for Enhanced Valuation Models

AI has revolutionized valuation models in real estate. It employs sophisticated algorithms to sift through large datasets. These algorithms identify patterns and predict property values with great precision. As a result, fund managers can make better-informed decisions. This reduces the margin of error found in traditional methods.

Generative AI in Real Estate

Generative AI brings diverse benefits to real estate. It can create detailed property visualizations, providing a clearer picture for buyers and investors. Additionally, it aids in automating the creation of smart contracts. This simplifies transactions and lessens legal complexities.

Case Studies of AI in Real Estate

Real estate AI case studies show the significant advantages of incorporating AI into property valuation. They highlight improvements in productivity, better market positioning, and notable cost savings. These examples emphasize AI’s crucial role in modern real estate. They cement its status as a vital tool for valuation.

| Feature | Traditional Valuation | AI-Powered Valuation |

|---|---|---|

| Speed | Moderate | High |

| Accuracy | Variable | High |

| Data Analysis | Manual | Automated |

| Cost Efficiency | Variable | Consistent |

Accessing High-Quality Data

The vitality of high-quality real estate data in the ever-evolving real estate market is monumental. Property and asset managers bank on advanced data platforms for cutting-edge information. These platforms, acting as property information databases, analyze vast data sets. They examine economic patterns and demographic shifts, empowering managers with the insights needed for informed decisions. Thus, they can adeptly forecast market movements and enhance investment results.

For data-driven real estate decision-making to be effective, property managers must adeptly handle varied data. They utilize advanced platforms to merge different data sources seamlessly. These tools provide deep insights, setting the stage for predictive and proactive decision-making. Embracing high-quality data access not only refines decision processes but also bolsters defenses against market unpredictability.

The Impact of Predictive Analytics

Predictive analytics reshapes the strategies of real estate stakeholders. By exploiting detailed data and advanced algorithms, it significantly influences the market. This approach provides insight into future trends.

Identifying Market Trends

Predictive analytics plays a crucial role in spotting market trends. A thorough platform for housing market research allows professionals to see market changes early. This foresight helps property and asset managers stay ahead, letting them update their strategies early.

Proactive Investment Strategies

Predictive analytics fosters proactive real estate strategies. Utilizing this data, managers can shift assets or adjust their strategies. This reduces risks and creates opportunities. Using predictive analytics safeguards against market instability and supports decisions rooted in data.

To summarize, predictive analytics is central to modern real estate. It refines proactive strategies, focusing on the future of asset and property management.

Centralized Data Repositories

Centralized data repositories are changing how property and asset managers organize information. They gather significant property data into one system, offering a unified view of a portfolio. This integration promotes better operational efficiency and decision-making.

Benefits of Data Integration

These repositories bring the primary advantage of merging data from different sources. They enable a thorough analysis and deep understanding of market trends. This unification supports effective strategic planning and enhances forecasting accuracy.

- Unified view of property information

- Enhanced market trend analysis

- Improved strategic planning

Improving Decision-Making with Real-Time Analytics

Real-time real estate analytics enhance the capabilities of centralized data systems. They deliver immediate insights, allowing managers to make quicker, informed choices. Tools for property market intelligence improve responsiveness and flexibility in investment management.

| Feature | Benefit |

|---|---|

| Real-time updates | Immediate insights for quick decision-making |

| Centralized data access | Holistic view of all property data |

| Integrated analytics | Enhanced market trend analysis |

Thus, the use of centralized data repositories and property market intelligence tools is key. They enable real-time analytics in real estate. This results in better decision-making and more efficient management. It marks a new efficiency era in property and asset management.

Real Estate Market Insights from Data Platforms

Real estate data platforms turn huge amounts of raw data into clear market insights. This enables both property and asset managers to make savvy decisions. These insights help managers tweak their strategies to match current trends. Through effective real estate data management, a deep dive into market behavior and financial forecasts is possible.

Interpreting real estate insights is key to hitting financial objectives without owning the properties. Data platforms merge info from many sources, improving decision-making. This merging helps managers foresee market changes and adapt to stay ahead. It’s about maintaining a strategic advantage in a fluctuating market.

A comprehensive real estate data system gives access to vital intelligence. It aids in strategic planning, mitigating risks, and analyzing investments. Simplifying complex data into easy-to-understand information helps managers meet clients’ financial goals. It enables efficient optimization of assets.

| Benefit | Details |

|---|---|

| Market Trends Analysis | Provides predictive analytics to identify future market movements. |

| Enhanced Decision-Making | Facilitates data-driven and informed real estate decisions. |

| Strategic Planning | Supports strategic initiatives by analyzing comprehensive data. |

Using these insights, both property and asset managers can tailor their strategies with the changing real estate scene. Thus, adopting advanced data platforms is crucial. It’s essential for making informed real estate decisions and reaching financial goals.

Data Centers as a Growing Investment Opportunity

Data centers are quickly becoming a vital part of modern real estate investment. The increase in demand for data storage and management has made them crucial. They offer an attractive option for long-term investments with stable returns.

The Role of Data Centers in Modern Real Estate

Data centers are essential in today’s digital landscape. They handle the storage and processing of vast amounts of data. This supports numerous online services and activities. Their significance is on the rise as more industries adapt to digital changes.

Investment Benefits and Challenges

Investing in data centers brings both rewards and hurdles. On the plus side, they promise a regular source of income from the ongoing need for storage solutions. They also have a high potential for capital growth. Yet, they face problems like high power usage and environmental concerns. These issues regarding their carbon footprint must be skilfully addressed for success.

Real Estate Data Management System Enhancements

Innovations in real estate data management systems highlight the goal of improving efficiency and reducing mistakes. Through cutting-edge tools, property and asset managers can enhance their operations. This process facilitates precise and quick management methods.

Streamlining Operations with Data Management Tools

State-of-the-art data management tools are crucial for enhancing operations in real estate. They make automating day-to-day tasks possible, freeing managers to concentrate on major decisions. With improved interfaces and better integration, workflows modernize, ensuring smooth data exchange across platforms.

- Automation of Routine Tasks: Minimize manual interventions by automating repetitive tasks.

- Integration Capabilities: Ensure seamless data flow and reduce data discrepancies.

Improving Efficiency and Accuracy

The focus on improving efficiency and accuracy is at the heart of new developments in real estate data management systems. Integrating AI for analytics and processing data in real time boosts the accuracy of portfolio metrics. This leads to more informed decisions, based on accurate, current data, better serving stakeholders.

- AI-Driven Analytics: Utilize AI to enhance predictive capabilities and accuracy in valuations.

- Real-Time Data Processing: Make informed decisions with the latest data, enhancing operational efficiency.

| Feature | Benefit |

|---|---|

| Automation | Streamlining Operations |

| AI-Driven Analytics | Accuracy Improvement |

| Real-Time Data Processing | Operational Efficiency |

| Integration Capabilities | Minimizing Inefficiencies |

The Future of Real Estate Data Platforms

The digital transformation of real estate continues to accelerate, with data platforms playing a crucial role. We are on the brink of significant changes, thanks to new technologies and trends. This evolution will reshape how we understand and interact with real estate markets.

Trends to Watch

At the heart of these trends, AI and machine learning are changing the game. They’re not just improving predictions. They’re also making property valuation and management more efficient. AI’s precise market analysis helps in making well-informed investment choices.

The Evolution of Data Tools in Real Estate

Future data platforms in real estate will feature even more sophisticated tools. These advancements will move us from old-school data handling to automated, intelligent systems. Additionally, better data visualization will make market and asset performance clearer. This puts property and asset managers in a powerful, strategic role.

The Role of Property Data Analysis Software

Property data analysis software is now crucial for modern real estate operations. By utilizing advanced real estate analytics, it provides deep insights into market trends. This aids in efficient property management and strategic decisions.

This technology offers a sophisticated approach to portfolio management. Every investment decision benefits from the support of solid data. By analyzing complex data sets, it enables property and asset managers to predict trends with accuracy. Consequently, they can adjust their strategies to foster growth.

These tools are key in spotting profitable opportunities and evaluating risks. They strengthen the basis of investment decisions. As the real estate field becomes more data-centered, effective property management will depend on sophisticated data analysis tools.

| Feature | Benefit |

|---|---|

| Market Trend Analysis | Helps in predicting market shifts for timely decision-making |

| Risk Assessment | Enables identification and mitigation of investment risks |

| Portfolio Optimization | Enhances portfolio performance through data-driven strategies |

Real estate data platforms: Key insights for modern property managers

Modern real estate management heavily depends on real estate data platforms. They provide crucial insights to property managers. These platforms do more than just integrate data. They help property managers make decisions based on detailed data analysis.

Insights for property managers from these platforms cover several areas. They include market trends, tenant behavior, and asset performance. With a real estate data platform, managers can quickly adapt to market changes and shape their strategies for better outcomes.

These platforms offer a major benefit by simplifying complex data sets. They turn raw data into actionable insights. This is vital for the success of modern real estate management, enhancing both operations and financial results.

| Feature | Benefits |

|---|---|

| Market Trends Analysis | Anticipate market shifts and adjust strategies accordingly |

| Asset Performance Metrics | Optimize asset management to improve returns |

| Tenant Behavior Insights | Enhance tenant satisfaction and retention |

Conclusion

The fusion of real estate and tech through data platforms presents unmatched opportunities for property managers. By utilizing advanced analytics and data-driven tools, a deeper insight into market dynamics is established. This leads to more intelligent and efficient property management strategies.

Emerging software solutions are not only improving operational efficiency. They’re also pivotal in molding the future of real estate data utilization. With innovations like predictive analytics and AI-enhanced valuation models, the management and strategy of real estate are being revolutionized.

The future of real estate data looks promising with ongoing enhancements and the adoption of new technologies. Property and asset managers stand to gain substantially from these developments. They enable more strategic decision-making and enhance the outcomes of real estate investments. For those in real estate management, embracing these tools and insights is crucial to thrive in this changing environment.

FAQ

What is a real estate data platform?

A real estate data platform is an advanced system for gathering and analyzing diverse data sets relevant to the real estate sector. It provides insights from data about property values, market trends, and demographics. This aids real estate professionals in making informed choices.

How does technology transform property management in the modern era?

Modern technology has transformed property management by introducing AI-based automated valuation and predictive analytics. These innovations boost the accuracy and efficiency of property assessments. They streamline operations and deliver important market insights. This makes managing properties more strategic and efficient.

What are the benefits of using a real estate data platform?

Real estate data platforms offer many advantages. They deliver in-depth market insights and improve decision-making with real-time analytics. Additionally, they streamline operations with efficient data management tools. These benefits help managers forecast market trends, refine strategies, and enhance management decisions.

How does AI improve property valuation processes?

AI improves property valuations by utilizing advanced algorithms to process large data sets swiftly for precise valuations. This technology identifies market patterns and trends effectively. It leads to more accurate property appraisals compared to traditional methods.

What role does generative AI play in real estate?

Generative AI contributes significantly to real estate, from creating lifelike property visuals to drafting intelligent contracts. It accelerates various tasks, offers detailed property insights, and improves property management efficiency.

Why is access to high-quality data crucial in real estate?

High-quality data is vital in real estate for informed investment decision-making. Detailed and accurate data help property managers anticipate market trends. They can then respond to changes strategically, minimizing risks and maximizing returns.

How can predictive analytics impact real estate investment strategies?

Predictive analytics enable investors to spot emerging market trends and shifts. With these insights, they can adjust their strategies proactively. This allows them to protect their investments and exploit growth opportunities.

What are the advantages of using centralized data repositories in real estate?

Centralized data repositories integrate data from different platforms, offering a comprehensive property overview. This amalgamation aids in making well-informed decisions through real-time analytics. As a result, property and asset management becomes more strategic and informed.

What insights can real estate data platforms provide to property managers?

Real estate data platforms deliver extensive market insights, aiding property managers in decision-making. By transforming vast data into useful knowledge, these platforms empower managers. They set and achieve financial objectives without directly handling facilities.

Why are data centers considered a growing investment opportunity in real estate?

Data centers are emerging as significant investment avenues due to their crucial role in the digital economy’s data storage and management. Their importance offers stable, long-term investment opportunities. This is fueled by growing demand, active mergers and acquisitions, and projected market expansion, despite energy and sustainability challenges.

How do advancements in real estate data management systems streamline operations?

New improvements in data management systems for real estate enhance operations by automating regular tasks, reducing inefficiencies, and improving performance metric accuracy. These innovations lead to more productive property management. They pave the way for continued profitability and growth.

What trends are shaping the future of real estate data platforms?

Real estate data platforms are evolving with trends like enhanced AI integration, advanced predictive analytics, and the development of innovative data tools. These trends are redefining property management, marketing, and investment practices. They promise a technology-driven future for the real estate sector.

How does property data analysis software support modern real estate operations?

Property data analysis software provides cutting-edge tools for evaluating market dynamics and reinforcing investment decisions. It facilitates detailed portfolio management. Furthermore, it aids real estate professionals in devising growth-oriented strategies.

What are the key insights provided by real estate data platforms for today’s property managers?

Real estate data platforms furnish essential insights, like market trends, property values, and demographic data. These insights assist managers in making knowledgeable decisions. They boost asset management and guide the creation of efficient real estate strategies.