The latest Real Estate Asset Management Report offers a comprehensive analysis of the current market landscape, revealing significant trends that inform and shape the industry’s future. As the world moves towards a post-pandemic reality, the real estate sector has recognized the lasting effects of changing work and commuting patterns on office market demand and downtown environments. Furthermore, investors remain cautious amid elevated interest rates and uncertainties in pricing transactions. Despite these challenges, there is a growing sense of optimism as inflation shows signs of subsiding, prompting investors to consider potential acquisition opportunities. This report highlights the importance of adapting to new market conditions and evolving environmental standards while providing insights into investment management and real estate market analysis.

Key Takeaways

- Remote work and changing commuting patterns have created lasting impacts on office space demand and downtown market dynamics.

- High interest rates and pricing uncertainties have led to increased investor caution and selectivity in asset allocation.

- The industry is moving towards embracing environmental, social, and governance (ESG) factors as an essential aspect of property management and investment strategies.

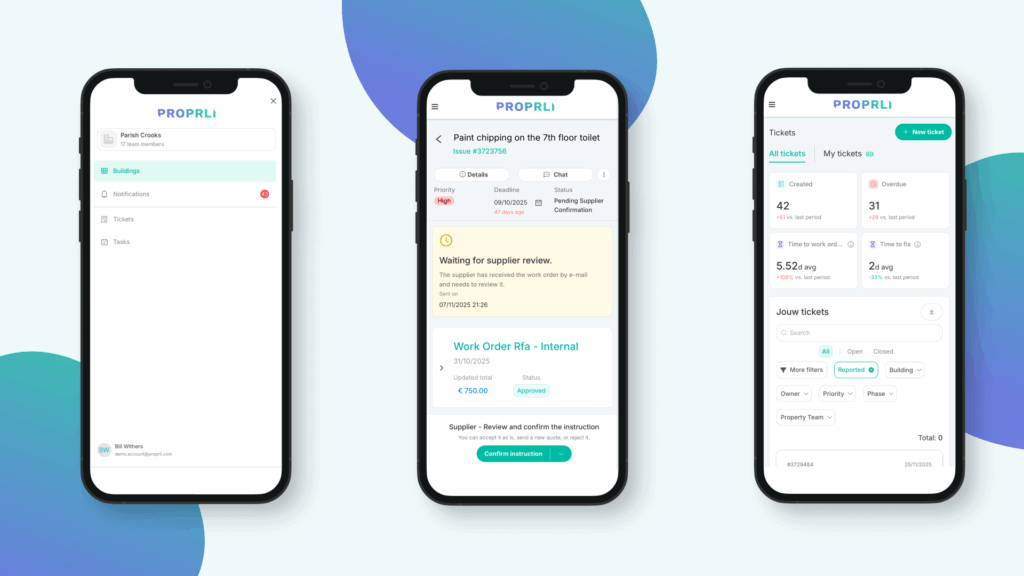

- Technological advancements, such as artificial intelligence and digital transformation, are revolutionizing real estate management and analytics.

- Adapting to market shifts and incorporating a sustainability focus in asset management strategies are vital to success in the current real estate industry landscape.

Introduction to Asset Management in Real Estate

Real estate asset management is a critical field that stands at the intersection of maximizing property value and investment returns while navigating the complex economic landscapes of the market. The current economic climate presents a myriad of challenges and opportunities for asset managers, particularly in the transitional phase post-pandemic. With interest rates poised to stay elevated, the strategic management of property portfolios demands more attention than ever. Asset managers must harness real estate analytics to identify lucrative opportunities and mitigate risks. Real Estate Asset Management is consequential to maintaining and increasing the value and profitability of real estate investments, especially in uncertain economic times.

The Importance of Real Estate Asset Management

Effective real estate management is vital in ensuring long-term growth and profitability of investments. By optimizing rental income, reducing operating costs, and minimizing risk, professional asset managers are able to deliver superior results. With the increasing complexity of the market, expertise in various property segments has become essential. In this context, knowledgeable asset managers play a significant role in devising tailored strategies to achieve the objectives of property investors and stakeholders.

Overview of the Current Real Estate Economic Climate

The ongoing economic climate has had a marked impact on property management and real estate investments. Surviving the shifting landscape requires resilience and adaptability, qualities which have become increasingly crucial in navigating the challenges of today’s market. As industry experts, asset managers use their expertise in real estate analytics to foresee and adapt to changes in market conditions, such as fluctuating interest rates, shifting tenant demands, and evolving environmental regulations.

Asset managers must also adapt to the rapid pace of technological advancements, leveraging innovative tools and software platforms for strategic and data-driven decision-making. In today’s real estate environment, staying abreast of the latest asset management trends and performance indicators can spell the difference between thriving and merely surviving.

The Evolution of Real Estate Post-Pandemic

In the wake of the pandemic, the real estate sector has witnessed a transformative shift with lasting effects on investment strategies and property management. Evolving work and commuting patterns have changed the dynamics of the real estate market, challenging long-held notions and demanding a reevaluation of real estate investment and portfolio management strategies.

Acceptance of New Work and Commuting Patterns

With the majority of the workforce adapting to remote work arrangements during the pandemic, businesses and employees alike have embraced a more flexible working model. Subsequently, real estate market analysis has revealed a profound impact on office space demand, as the need for onsite office areas decreases. This calls for a strategic rethinking of property management strategies to adjust to an increasingly remote workforce.

Impact on Office Space Demand and Downtown Dynamics

Larger cities are grappling with the changes in office space demand and downtown dynamics, urging reformation of real estate investment approaches. High-quality properties that cater to the market’s evolving needs are viewed as keys to future success, while the market has sharply bifurcated between high-end properties and less sought-after spaces. In contrast, smaller and growing cities have experienced a thriving and expanding office market, presenting new opportunities for real estate investment.

To stay ahead in the transforming landscape, investors and portfolio managers must pay close attention to trends, using real estate market analysis to make informed portfolio management and investment decisions. Adapting real estate investment and property management strategies is crucial for capturing new business opportunities and ensuring long-term growth within the sector.

Real Estate Investment Management Challenges and Opportunities

Amid the current market conditions, the realm of real estate investment management faces both challenges and opportunities. Factors such as tightened credit access and rising interest rates, initiated by the Federal Reserve in March 2022, have resulted in reduced loan originations across all major debt sources. These constraints affect sales and prompt investors to adopt a more cautious approach in asset allocation. However, as the Emerging Trends Barometer reveals, the appetite for quality assets remains strong, indicative of the real estate opportunities that lie ahead.

Striking the right balance between risk and return is essential in investment management, and the key challenge in this environment lies in identifying undervalued assets. By harnessing market analysis tools, investors can anticipate more favorable conditions and adapt their strategies accordingly.

- Focus on quality assets that are aligned with market demands and environmental, social, and governance (ESG) factors.

- Conduct thorough market research to identify real estate opportunities in emerging markets and developing cities.

- Consider diversifying real estate asset allocation to mitigate risks associated with interest rate fluctuations and market volatility.

While the present challenges in investment management may seem daunting, real estate investors willing to adapt and evolve can seize the opportunities that come with potential market adjustments. By employing real estate market analysis, careful asset allocation, and staying attuned to the industry’s shifting landscape, investors can successfully navigate through the challenges and thrive in the world of real estate investment management.

Insights on Real Estate Market Analysis and Predictions

The real estate market has been experiencing significant shifts due to economic and social factors in the post-pandemic world. Delving deep into real estate analytics can provide valuable insights into sales transactions and price clarity issues that can impact asset valuation and deal-making. In addition, understanding the prospects for investment amidst interest rate changes can help investors adapt and capitalize on emerging opportunities.

Analysis of Sales Transactions and Price Clarity Issues

The real estate report highlights the challenges posed by the substantial reduction in sales transactions that have occurred, leading to price clarity issues. Due to the lack of agreement on pricing between buyers and sellers, deal-making becomes complicated, and asset valuation processes are impacted. To navigate these challenges, the reliance on real estate analytics becomes crucial in uncovering trends and providing useful insights for investors.

Prospects for Investment Amidst Interest Rate Changes

Interest rate changes have a significant effect on the real estate market, dictating investment prospects and strategies. Notwithstanding the current challenges, predictions suggest that recent and anticipated price declines may create a more advantageous landscape for investment. Investors ready to capitalize on these opportunities can potentially tip the industry in favor of growth, depending on the trajectory of interest rates and the resulting economic upswing. Understanding the interplay between interest rate adjustments and market conditions is key to unlocking potential investment opportunities for long-term success.

Technological Advancements in Real Estate Management

The integration of technological advancements in real estate management has ushered in a new era marked by increased efficiency and innovation. One of the primary drivers of this transformation is the emergence of artificial intelligence (AI) in various aspects of the industry.

AI has enhanced property search and analysis, allowing for more targeted and accurate results. This technology helps professionals to quickly and effectively identify potential properties that match their clients’ needs and preferences. The utilization of AI-based algorithms for screening, filtering, and aggregating data has streamlined the decision-making process, saving valuable time and resources.

Furthermore, AI-driven tools contribute to streamlining the due diligence process for real estate transactions. These cutting-edge solutions automate and expedite traditional manual processes, such as property valuation, title verification, and risk assessment. As a result, real estate professionals can achieve greater accuracy while reducing the time spent on these tasks.

Another critical area where AI is making a significant impact is in the detection and prevention of transactional fraud. Leveraging machine learning algorithms, AI powered tools can spot unusual patterns and discrepancies in financial and non-financial data, flagging potential fraudulent activities in real time. This added layer of security is crucial in safeguarding the interests of both buyers and sellers in an increasingly digitalized real estate landscape.

Apart from AI, other technological advancements are shaping the future of real estate management. These innovations include:

- Smart building technologies – Implementing IoT-based sensors and intelligent building management systems to optimize energy consumption, maintenance routines, and overall building performance.

- Virtual and Augmented Reality (VR/AR) – These technologies enable immersive virtual tours, facilitating remote property inspections and enhancing the overall property buying experience.

- Blockchain – By providing a secure, transparent, and efficient platform for real estate transactions, blockchain has the potential to revolutionize property ownership transfer, financing, and lease management.

By embracing these technological advancements, the real estate industry can significantly improve its processes, reduce operational costs, and offer better services to its clients. This ongoing digital transformation is expected to create new demand for office spaces, as businesses realize the potential of technology-enabled, flexible, and collaborative work environments. Consequently, real estate management firms must stay attuned to these emerging trends to ensure their property offerings align with evolving market needs and expectations.

Real Estate Asset Management Report: Navigating High Interest Rates and Inflation

The current economic landscape, characterized by high interest rates and inflation, serves as a pivotal focal point in the latest Real Estate Asset Management Report. The industry is exploring ways to adapt growth strategies within this paradigm, recognizing the importance of such adaptations for success going forward.

It is crucial for property investors and managers to tailor their investment strategies to thrive in this ‘higher-for-longer’ interest rate environment. Considering the significance of these challenges, we have identified three key areas property investors should focus on to navigate the current economic climate:

- Interest Rate Risk Management

- Inflation Hedging

- Emphasis on Quality and Diversification

With a keen understanding of interest rate risk management, investors can mitigate the potential negative impact of rising interest rates on their portfolios. This may involve refinancing at fixed rates, utilizing interest rate swaps or caps, or even shortening investment time horizons.

Inflation hedging is another crucial aspect of property investment strategy in the face of increasing inflationary pressures. Real estate has traditionally served as an effective hedge against inflation, but the nature of current inflationary trends necessitates the need for cautious selection of investments with strong cash flows and the potential for rental growth.

The final aspect of a successful property investment strategy is a focus on quality and diversification. Investors should seek high-quality, well-located assets that are more resilient to economic fluctuations, as well as maintain a diverse portfolio to minimize risks.

| Strategy | Benefits |

|---|---|

| Interest Rate Risk Management | Mitigates negative impact of rising interest rates on portfolio |

| Inflation Hedging | Provides protection against eroding portfolio value due to rising inflation |

| Quality and Diversification | Enhances portfolio resilience and reduces risk exposure |

In conclusion, the Real Estate Asset Management Report highlights the significance of adapting property investment strategies in response to the current economic landscape shaped by high interest rates and inflation. Investors must remain vigilant and agile in managing risks and seizing opportunities, while emphasizing quality and diversification in their portfolio management.

Evolving Practices in Property Management with ESG Considerations

In an era of growing environmental awareness and stringent regulations, property management practices have been undergoing a significant shift towards incorporating environmental, social, and governance (ESG) factors into their strategic decision-making processes. This has led to increased focus on sustainability and resilience in real estate operations and investments. In this section, we will discuss the regulatory impacts driving these changes and explore how the industry is adapting to rising insurance costs and climate event preparedness.

Regulatory Impacts and Sustainability Focus in Real Estate

The real estate industry has been experiencing growing pressure from heightened government regulations and mandates centered around ESG considerations. These regulations aim to promote sustainable and responsible practices across property investment and management, encouraging innovative approaches in addressing areas like energy efficiency, water conservation, and carbon emissions reduction. As a result, property managers are increasingly incorporating sustainability in real estate and adjusting their business strategies to ensure compliance with such measures while emphasizing long-term value creation for stakeholders.

Rising Insurance Costs and Climate Event Preparedness

Another catalyst for the real estate industry’s evolving practices in property management is the surge in insurance costs due to an increase in frequency and severity of climate events. This scenario not only raises concerns about the financial viability of coverage but also holds the potential to constrain rent increases. As a response, property managers and owners are focusing on integrating resilience and responsible asset stewardship into their practices. This includes strategies like investing in physical infrastructure improvements to protect existing assets, assessing and addressing climate change vulnerability across their portfolios, and prioritizing low-carbon and resource-efficient building designs.

Incorporating ESG considerations into property management practices is essential for adapting to the regulatory landscape and managing climate-induced risks. By emphasizing sustainability in real estate and fostering resilience, property managers can contribute to the long-term success of their investments and help create a more sustainable future for the industry.

Shifts in Asset Allocation and Portfolio Management Strategies

The real estate market is currently experiencing significant shifts in asset allocation and portfolio management strategies. These changes are driven by investors’ growing cautiousness and emphasis on quality, as well as a market focus on sustainability and long-term resilience. In this section, we will explore how these factors are influencing real estate investment decisions and shaping the future of the industry.

Increasing Cautiousness Among Real Estate Investors

As a result of current market conditions, real estate investors are becoming increasingly cautious in their investment choices, with an inclination towards selectivity. This is due to the high valuation of quality properties that align with current investor and tenant needs. Consequently, many investors are adopting a conservative approach when it comes to asset allocation and portfolio management, concentrating on lower-risk, high-quality properties that promise secure returns.

Adapting to a Market Focused on Quality and Sustainability

As the real estate market shifts its focus towards quality and sustainability, market players are having to adapt their strategies in response. This involves considering issues related to sustainability and long-term resilience more seriously than ever before, with an emphasis on environmentally-friendly building practices and resource conservation. This market focus on quality and sustainability has also prompted investors to reconsider their asset allocation choices, seeking out properties that not only offer stable returns but also align with the values of an environmentally-conscious world.

In conclusion, the real estate market is witnessing transformative shifts in asset allocation and portfolio management strategies. Investors are gradually adopting a more cautious and selective approach to their investments, with an emphasis on high-quality properties that cater to modern demands. At the same time, the industry is adapting to a market focus on sustainability and long-term resilience, shaping the future of real estate investments and ensuring a more responsible and environmentally-conscious market landscape.

The Role of Digital Transformation in Real Estate Analytics

Digital transformation has significantly impacted the real estate sector, particularly in the realm of real estate analytics. By adopting asset management technology and advanced data analytics tools, professionals can optimize their portfolios and make better-informed decisions. The introduction of these technologies has redefined the traditional asset management process, resulting in greater efficiency and more sophisticated analysis techniques.

With digital transformation comes the ability to harness powerful data-driven insights on market trends and opportunities. Key components of the digital transformation in real estate analytics include:

- Machine learning algorithms to recognize patterns and predict market performance

- Data visualization tools for easy interpretation of complex trends

- Automated valuation models, enabling the efficient assessment of property values

- Geospatial data analysis for better understanding of location factors and their influence on property values

As real estate professionals integrate technology into their daily workflows, they must stay updated on industry advancements and continuously improve their skills in harnessing these tools.

| Technology | Application in Real Estate Analytics |

|---|---|

| Machine learning | Predicting market performance and identifying growth opportunities |

| Data visualization | Interpretation of complex data sets and trends |

| Automated valuation models | Efficiently determining property values |

| Geospatial data analysis | Understanding the impact of location factors on property values |

Embracing digital transformation in real estate analytics presents a vast array of opportunities for professionals to optimize their portfolios and streamline their decision-making processes. As the real estate sector continues to evolve, so too must our understanding and implementation of advanced technologies and analytics techniques in order to maximize the potential of this transformative trend.

Real Estate Asset Management & Consulting Industry Overview

The Real Estate Asset Management and Consulting industry significantly influences business strategies and guides investment decisions. In this section, we provide an overview of the industry, focusing on key revenue statistics, employment data, market size evaluations, and service segments vital to understanding the industry’s structure and economic impact.

Revenue, Employment, and Market Size Statistics

The revenue generated by real estate asset management & consulting industry has been on an upward trajectory over recent years, driven by increasing real estate transactions, property values, and demand for specialized consulting services. Employment within this industry is also growing, with more professionals seeking opportunities in this dynamic field, including property and asset managers, analysts, and consultants.

Market size in terms of total industry revenue is essential to understanding the scope and significance of real estate asset management & consulting. Several factors influence market size, such as economic growth, the performance of real estate markets, urbanization, and overall investment trends. Global real estate markets are currently experiencing a phase of high demand and increased focus on specialized services, resulting in a burgeoning industry.

Key Product and Service Segments in Real Estate Consulting

Real estate asset management & consulting firms offer a diverse range of services to cater to the varying needs of their clients. Key service segments in the industry include:

- Property management

- Investment strategy development

- Portfolio management

- Real estate market analysis

- Property valuation and appraisal

- Lease negotiation and administration

- Due diligence and risk assessment

Each distinct service segment adds value to the overall market by providing expertise and professional advice tailored to clients’ specific needs, ensuring they navigate the complex real estate market with confidence.

In summary, understanding the real estate asset management & consulting industry is vital for investors and professionals seeking to make informed decisions. By grasping the key trends, market size, and significant service segments in this industry, stakeholders can better position themselves to capitalize on the current market dynamics and optimize their real estate investments.

Conclusion

As real estate trends continue to evolve, the Real Estate Asset Management Report provides a holistic overview of the industry’s many facets, shedding light on economic and environmental challenges while highlighting innovative solutions borne out of technological advancements. The report emphasizes the importance of flexible and adaptive asset management strategies in today’s dynamic market landscape, as well as the critical role that real estate consulting services play in guiding businesses and investors to make informed decisions for both industry growth and returns.

By staying ahead of complex changes and incorporating insights gleaned from market analysis and professional expertise, real estate asset managers and consultants can help businesses thrive in the face of fluctuating economic climates, regulation, and emerging technologies. Through this comprehensive approach, industry stakeholders can effectively navigate challenges and capitalize on opportunities to foster industry growth and ensure success in the rapidly changing real estate landscape.

In conclusion, the effectiveness of asset management strategies and the value provided by real estate consulting services are paramount in the ever-changing world of real estate. By remaining agile and responsive to shifting market dynamics, industry professionals can contribute positively to business success, investor returns, and overall industry growth, as evidenced by the vital insights and trends discussed in the Real Estate Asset Management Report.

FAQ

What is the Real Estate Asset Management Report?

The Real Estate Asset Management Report is an annual publication providing key insights and trends in the real estate industry, covering various aspects such as market analysis, investment management, portfolio management, and property management strategies.

How has the post-pandemic landscape impacted real estate markets?

The post-pandemic landscape has significantly impacted real estate markets, with shifts in work and commuting behaviors affecting office space demand and downtown dynamics. The industry has embraced these changes and is adapting its investment and portfolio management strategies accordingly.

What challenges and opportunities exist in real estate investment management?

Real estate investment management faces challenges such as tightened credit access, rising interest rates, and reduced loan originations. However, there are also opportunities for investors to capitalize on undervalued assets and favorable market conditions in anticipation of potential adjustments.

How have technological advancements impacted real estate management?

Technological advancements, such as artificial intelligence, have significantly impacted real estate management by streamlining processes, enhancing property search and analysis, and improving transactional fraud detection, resulting in increased efficiency and innovation.

How are ESG considerations influencing property management practices?

ESG considerations are becoming increasingly important in property management practices due to heightened government regulations, sustainability mandates, and rising insurance costs resulting from climate events. The real estate sector is focusing on resilience and responsible asset stewardship to address these concerns.

What role does digital transformation play in real estate analytics?

Digital transformation plays a crucial role in real estate analytics by enabling asset managers to leverage advanced data analysis techniques for portfolio optimization and informed decision-making, leading to more sophisticated market insights and investment opportunities.

How is the real estate asset management and consulting industry structured?

The real estate asset management and consulting industry is structured through its various revenue streams, employment data, and market size evaluations. It comprises key product and services segments, each contributing different value to the overall market and shaping the industry’s economic impact.

Source Links

- https://www.ibisworld.com/united-states/market-research-reports/real-estate-asset-management-consulting-industry/

- https://www.pwc.com/us/en/industries/financial-services/asset-wealth-management/real-estate/emerging-trends-in-real-estate.html

- https://www.linkedin.com/pulse/future-asset-management-trends-insights-from