When you’re on the verge of a major real estate acquisition, knowing the ins and outs of due diligence is not just beneficial, it’s essential. As a asset manager, you understand that a due diligence checklist serves as your blueprint for uncovering any risks before they become costly errors. With the proper application of this checklist, you can align each property with your investment strategy and conduct a thorough risk analysis that will give you, and your stakeholders, peace of mind.

Committing to a structured real estate due diligence process is more than due diligence; it’s a vote of confidence in your professional expertise. Navigating the intricate layers of asset management combines your unique skills with meticulous research and factual data collection to propel your real estate acquisitions to successful conclusions.

Key Takeaways

- Real estate due diligence is critical for aligning with your investment goals and managing risks.

- A due diligence checklist is an indispensable tool for asset managers.

- The checklist provides transparency and assists in making informed decisions in real estate acquisitions.

- Efficiencies in due diligence can be realized through adopting systematic approaches.

- Identifying potential risks early on is necessary for a confident investment.

- Proper real estate due diligence reaffirms credibility and operational excellence.

Understanding the Due Diligence Process in Real Estate

Entering into a real estate transaction requires an in-depth understanding of the due diligence process, a pivotal step in making an educated decision regarding property investments. This comprehensive analysis affords you the ability to scrutinize details and gauge potential risks, ensuring no stone is left unturned.

Defining Due Diligence in Asset Management

At its core, the real estate due diligence process is about meticulous investigation. Think of it as a safeguard—your guardrail against unforeseen complications. As you dive into property evaluation, you should be looking for a property investment checklist that aligns with your objectives and empowers you to make data-driven decisions.

Phases of Due Diligence: From Preliminary to Post-Offer

The due diligence process is segmented into critical phases, beginning with a preliminary checklist. This serves as your first line of defense, offering a snapshot of the property’s viability. As you move forward, your focus sharpens during the underwriting phase, where risks and rewards are weighed with greater complexity.

- Preliminary Analysis: Quick assessment of property basics.

- Risk Assessment: Detailed investigation into potential risk factors.

- Final Evaluation: The decisive point where investment feasibility is confirmed.

Timeframes for Effective Due Diligence

Time is of the essence when it comes to real estate due diligence. Typically, the due diligence period spans 30-90 days, securing your window of opportunity to conduct thorough evaluations. Some situations even afford “free look” periods—exclusive rights to analyze the property unhindered, setting the stage for a well-informed decision.

| Due Diligence Phase | Duration | Key Considerations |

|---|---|---|

| Preliminary Checklist | First 15 days | Basic property information and market condition analysis |

| In-Depth Analysis | 16-45 days | Structural, legal, and financial assessments |

| Final Review and Negotiation | 46-90 days | Final report review, price negotiation, and closing preparations |

A wisely managed due diligence process not only influences immediate investment outcomes but also frames the groundwork for a robust portfolio. Now that you have a grasp on what the journey entails, ensure each step is taken with confidence and strategic insight.

Preparing Your Preliminary Real Estate Due Diligence Checklist

Embarking on a real estate acquisition means ensuring that every detail has been meticulously considered. Your due diligence is foundational to a successful investment. This comprises scrutinizing a variety of documents and reports to safeguard your interests right from the start. By thorough vetting through a buying checklist, understanding due diligence documents, reviewing property tax bills, environmental reports, capital expenditures, and assessing the property condition report, you can proceed with confidence.

Legal Documentation Overview

Begin with the core of legal intricacies. Review every title policy, government-issued document, and ensure property tax bills for the past three years are accurate and up-to-date. This preliminary gathering of paperwork will reveal any legal stumbling blocks that might surface later on.

Structural and Construction Plan Assessment

The integrity of the property’s structure cannot be overlooked. Scrutinize as-built plans and any architectural or engineering documents available. This step is vital for understanding the property’s true condition beyond mere appearances.

Review of Recent Capital Expenditures

Inspect records of recent investments into the property. Capital expenditures can indicate proactive management or, conversely, a history of issues that required significant outlay. Understanding where and how money has been spent on the property can paint a clearer picture of what future costs might await.

- Examination of due diligence documents for transparency

- Validation of the last three years’ worth of property tax bills

- Analysis of environmental reports for potential liabilities

- Review of capital expenditures for insight into the property’s upkeep

- Evaluation of the property condition report for any major defects or concerns

Armed with this knowledge, you’re well-equipped to make an informed decision on whether to continue pursuing the property or to step back and reconsider. It’s these preparatory steps that set the foundation for a robust investment strategy grounded in prudence and due diligence.

Conducting a Comprehensive Property Inspection

Embarking on a property inspection forms the cornerstone of any meticulous due diligence process. As you scrutinize the estate, you’re not just looking at the surface — you’re delving into the bones of the property, assessing its property condition and ensuring that factors like market accessibility and building fees are transparent and within acceptable bounds.

Your detailed site inspection should focus on various aspects of the property, from the quality of construction to the efficacy of existing systems. It’s crucial to assess these characteristics to understand the total cost of ownership and to mitigate potential post-purchase surprises.

- Evaluate the condition of structural elements, such as foundations, roof, and walls.

- Check the quality and functionality of mechanical and electrical systems.

- Assess exterior factors influencing accessibility, like adjacent roads and public transport convenience.

- Review legal easements and right-of-ways that might affect future modifications or property use.

Part of a comprehensive inspection includes understanding the common area maintenance charges, which are instrumental in deciding how building fees are allocated and shared among tenants. This transparency in costs contributes to more harmonious landlord-tenant relationships and financial planning.

| Checklist Item | Observations | Notes |

|---|---|---|

| Structural Integrity | Condition of the foundation, walls, and roofs. | Identify any repairs or reinforcements needed. |

| System Functionality | Efficiency of HVAC, plumbing, and electrical systems. | Plan for replacements or upgrades if necessary. |

| Accessibility | Proximity to crucial infrastructure and services. | Evaluate potential improvements or legal hindrances. |

| Maintenance Costs | Review CAM and other related expenses. | Determine the fairness and accuracy of charges. |

Remember, the insights you gain from a property inspection are vital. They shape your final decision and help in negotiating better terms, ensuring you make an informed investment. As you step through each part of the property, remember that thoroughness now can save you from unforeseen expenses and complications down the road.

The Real Estate Due Diligence Checklist for Financial Analysis

Embarking on the financial aspect of real estate due diligence, you’ll navigate through the intricacies of property appraisals, rent rolls, and operational expenses. This investigation ensures that the financial underpinnings of your potential acquisition are as solid as the infrastructure itself.

Evaluating Property Appraisal Reports

Property appraisal stands as a critical element of real estate analysis, transcending mere valuations. It encapsulates the financial & insurance viability of a property. Your aim here is to uncover underlying values and potential forecast growth, offering assurances or revealing red flags that could sway your investment decision. Appraisal reports are not just about current values but also include an examination of market trends and area developments which can impact future valuations.

Analyzing Rent Rolls and Tenant Leases

Your proficiency in evaluating the rent roll directly affects your ability to determine a property’s income potential. These records detail the lease status, rental rates, and the duration of tenant agreements. They play a pivotal role in understanding the property’s performance and stability over the long term. While scrutinizing rent rolls, it’s vital to consider ancillary tenant expenses and ensure these are aligned with market norms to sustain tenancy and profitability.

Scrutinizing Service Contracts and Operating Expenses

Comprehensive financial due diligence extends to the dissection of service contracts and operating expenses. Dive deep into service agreements to ascertain any embedded financial commitments or implications for future cost savings. Understanding and evaluating every line item of a property’s operating expenses positions you to better navigate the competitive analysis landscape, keeping your investment resilient against unforeseen financial pressures.

| Financial Metric | Details to Examine | Reason for Scrutiny |

|---|---|---|

| Property Appraisal | Market trends, comparable sales, replacement costs | Accurate insurance coverage, future value projections |

| Rent Roll | Lease durations, rent rates, security deposits | Revenue stability and tenant retention insight |

| Operating Expenses | Utility costs, maintenance fees, management charges | Operational efficiency and potential cost-saving areas |

Key Legal Considerations in Property Transaction

When you’re embarking on a real estate acquisition, understanding the nuances of property law is crucial. Whether it’s commercial or residential property that’s caught your eye, every detail from the legal description of the property to the potential for pending litigation must be reviewed with precision. These elements are not just about dotting I’s and crossing T’s; they directly influence the value and the very transferability of the property you’re considering.

Let’s focus on some legal cornerstones that can safeguard your interests and ensure that your property transaction avoids unpleasant surprises down the road. These factors are key to maintaining the integrity of your real estate dealings and ensuring that all property law requirements are in compliance.

- Pending Litigation: This is a red flag that could signal significant future liabilities or restrictions regarding the property. Thorough verification for any lawsuits or legal disputes is non-negotiable to protect your investment.

- Legal Description: You must ensure that the property’s legal description matches the actual land and improvements. Any discrepancies here can lead to challenging discrepancies later.

- Property Law Compliance: Ensuring the property meets zoning laws, building codes, and other regulations is pivotal. This due diligence is a protective measure for both the buyer and the seller in the transaction.

Think of these steps as vital checkpoints that, if properly cleared, lead to a sound, secure real estate deal. Overlooking these details could mean betting on an uncertain future for your newly acquired asset.

Here’s a comprehensive checklist table for quick reference during your due diligence:

| Legal Checkpoint | Details to Verify | Importance |

|---|---|---|

| Pending Litigation | Existence of any current lawsuits or legal claims against the property | High – Can affect ownership rights and property value |

| Legal Description Accuracy | Correlation of property size, boundaries, and easements with public records | Essential – Prevents future disputes and potential transaction disputes |

| Property Law & Regulation Adherence | Compliance with local zoning laws, building codes, land-use regulations | Critical – Noncompliance can result in fines and limits on property use |

Remember, real estate transactions are complex, and it’s the layers of due diligence, especially those concerning legal matters, that assure a deal is sound and profitable. Take your time to assess and investigate these aspects rigorously; your future self, enjoying the benefits of a well-chosen property, will thank you for it.

Zoning, Title Surveys and Other Compliance Mandates

When at the threshold of acquiring property, understanding and navigating the due diligence process is paramount. Part of this exploration requires you to dive into specific details surrounding local governance and documentation, such as the ALTA survey, to ensure every aspect of zoning compliance is met. Let’s delve further into the steps to secure municipal acquiescence and mitigate potential property encroachments, ensuring your investment is protected from unforeseen complications.

Securing Municipal Compliance and Permits

When dealing with real estate, it’s crucial to align with municipality regulations. This stage of the due diligence process involves an exhaustive review of zoning laws to ascertain that the use of your property complies with local rules, often requiring the procurement of permits or variances. Whether it’s a commercial development or a residential makeover, attainment of the right permits serves as a safeguard against legal disputes and fines.

Addressing Property Liens and Encumbrances

Likewise, part of your due diligence is to identify any existing property liens or encumbrances that could impact your ownership rights. From taxes due to easements granted, these can all shape the value and usability of your property. Conducting a thorough title search will illuminate any such issues, allowing you to address them before they escalate into major hurdles post-acquisition.

| Mandate | Relevance | Action Required |

|---|---|---|

| ALTA Survey | Assesses property boundaries and improvement locations | Commission an up-to-date ALTA survey |

| Zoning Laws | Ensures property adherence to local land-use regulations | Obtain necessary zoning permits and variances |

| Property Encroachments | Identifies violations or issues with adjacent properties | Conduct a boundary survey to detect and resolve encroachments |

| Municipality Regulations | Guarantees compliance with local government standards | Secure all required municipal certificates and inspections |

By staying vigilant and informed about these key aspects, you secure not only your investment but also its future potential. Remember, the due diligence process is a safety net that ensures your property acquisition is sound, lawful, and wise.

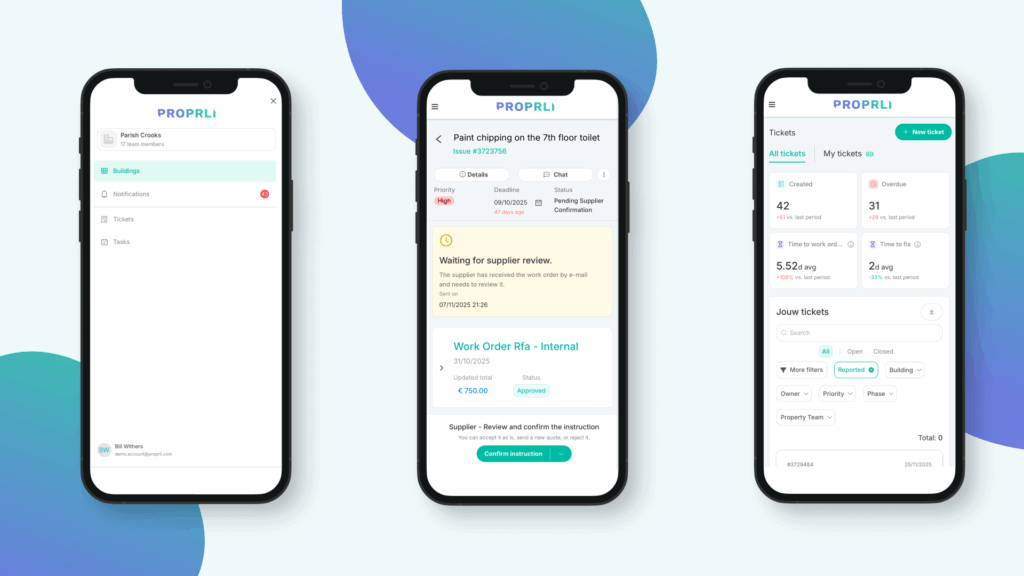

Digitizing Your Real Estate Due Diligence Efforts

As you seek to enhance operational efficiency in your real estate ventures, embracing digitization tactics can revolutionize the way you approach due diligence. Moving away from cumbersome spreadsheet-based practices to cloud-based deal management platforms, you create a seamless and more organized due diligence process. This digital transformation not only cuts down on time-consuming manual tasks but also offers a leap in accessibility and data control.

Consider the benefits you could reap by employing digitization in your next project. You could improve your workflow substantially through the use of targeted software designed to streamline each phase of due diligence. This leads to a more agile and responsive approach to deal handling, allowing you to make data-driven decisions swiftly.

- Immediate access to due diligence checkpoints

- Real-time updates and notifications

- Document management with simplified search and retrieval

- Collaboration tools for team-based projects

- Data analytics to inform strategic decision-making

By applying digital tactics, the entire lifecycle of a deal becomes more transparent and manageable. The following table illustrates a comparison of traditional methods versus digitized processes in real estate due diligence.

| Due Diligence Aspect | Traditional Methods | Digitized Approach |

|---|---|---|

| Data Collection | Manual aggregation of physical documents | Automated data entry and secure cloud storage |

| Task Assignment | Communications via email/meetings | Integrated task management with real-time tracking |

| Report Generation | Time-intensive compilation | One-click report generation and customization |

| Update Dissemination | Manual distribution of changes | Instant updates through synchronized platforms |

| Collaboration | Limited to in-person and scheduled calls | Dynamic, cloud-based, multi-user engagement |

With a digitized system, the once tedious parts of due diligence become streamlined, turning complex data sets into an organized, actionable format. This evolution is paving the way toward smarter and faster real estate transactions, positioning innovators at the forefront of the industry.

Collaborating with Financial Institutions: Alignment with the Due Diligence Sequence

Applying for financing in the context of real estate acquisitions requires careful alignment with the due diligence process. As you navigate the waters of property investment, it is critical to synchronize every move with your financing strategy to meet the demands of both financial institutions and due diligence requirements.

Navigating the Financing Application Process Amid Due Diligence

When you commence the process of applying for financing, you’re also pledging to fulfill certain lender requirements. Often, these overlap with due diligence findings, providing a clearer pathway forward. For instance, lenders usually request environmental reports – a common element in the due diligence checklist. By cooperating with financial institutions, you can strategize to collate these overlapping requirements effectively.

Aligning Lender Requirements with Due Diligence Findings

Due diligence and financing go hand in hand. The thorough investigation that due diligence involves can aid in meeting lender requirements which are often stringent and detailed. Lenders look for assurance and reduced risk, and the information uncovered during due diligence can provide just that. Let’s take a closer look at how these elements come into play:

| Due Diligence Component | Lender Requirement | Benefit of Alignment |

|---|---|---|

| Environmental Reports | Property Environmental Assessment | Meets risk assessment criteria for both parties |

| Appraisal Reports | Valuation for Financing Approval | Ensures the property value aligns with loan amount |

| Title Surveys | Clear Title for Mortgage Processing | Confirms legal standing and ownership for secure lending |

| Operating Expenses Analysis | Debt Service Coverage Ratios | Indicates viable financial model for loan sustainability |

Systematizing Data for Precision in Real Estate Analysis

When you’re delving into the world of real estate investments, the power of precision cannot be overstated. Sifting through copious amounts of property data can be daunting. However, by systematizing real estate data, you not only streamline the due diligence process but also greatly increase the accuracy and reliability of your analyses. The application of sophisticated investment software allows for a structured approach to evaluating properties, ensuring that no detail is overlooked.

One of the greatest advantages of leveraging advanced software is the creation and implementation of standardized checklists. These checklists serve as comprehensive guides that guarantee consistency in data collection and analysis across various properties. This standardization reduces the possibility of human error, creating a robust framework for investment decisions.

- Consistency in auditing real estate documents

- Uniformity in the assessment of property values

- Integrated approach to evaluating market trends

Moreover, precise data systematization facilitates effective risk mitigation. By identifying potential issues early in the due diligence process, you can take preemptive steps to avoid costly oversights. A documented chain of accountability also emerges, clarifying roles and responsibilities and thus contributing to a more transparent investment framework. With these tools at your disposal, the path to a successful real estate portfolio is more accessible than ever.

Ensuring Accountability and Visibility in Asset Management

As a vital part in real estate due diligence, the aspect of accountability in asset management cannot be overstated. It is the backbone that supports operational transparency and reinforces trust among all parties involved. In your role, understanding the importance of a structured document custody system helps safeguard the integrity of the asset management process.

Creating a Chain of Custody for all Due Diligence Documents

Documenting the flow of vital documents is key to maintaining a clear chain of custody. This responsibility ensures every critical piece of information is accounted for, from the initial title search to the latest environmental reports. Your meticulous attention to detail in managing these records is fundamental to validating the due diligence performed on a property.

Implementing Accountability Measures

In fostering a culture of accountability within assetmanagement, specific measures must be put into place. This includes delineating roles and assigning clear responsibilities, as well as instituting regular audits. These steps guarantee that all actions are transparent, creating a trustable environment for investors, management, and tenants alike.

| Due Diligence Stage | Documentation Required | Responsible Party | Audit Frequency |

|---|---|---|---|

| Preliminary Assessment | Title Policies, Environmental Reports | Due Diligence Analyst | Annual |

| Financial Analysis | Rent Rolls, Appraisal Reports | Financial Manager | Bi-Annual |

| Legal Review | Zoning Compliance, Property Liens | Legal Advisor | Upon Transaction Closure |

| Final Acquisition | ALTA Survey, Building Inspection Report | Acquisition Manager | Post-Acquisition Review |

Conclusion

As you delve into the realm of property investment, the importance of a methodical real estate due diligence checklist cannot be overstated. Such an approach not only lays the groundwork for a successful property investment but also ensures that every facet of the transaction meets your rigorous standards for excellence. By engaging in thorough evaluation and conducting in-depth legal and financial analyses, you enhance your ability to make informed decisions that resonate with savvy investing principles.

As asset managers, aligning your strategy with asset management best practices is essential. This alignment involves not just painstaking attention to detail but also the adoption of digital tools that refine and streamline your operations. Through these practices, you solidify your reputation in the industry, demonstrating commitment to transparency and precision in every phase of the investment cycle.

In summary, your quest for robust investment outcomes depends on your resolve to implement exhaustive due diligence practices. By integrating a systematic checklist into your operational protocol, you assert control over the multitude of variables that define real estate transactions. Undoubtedly, this disciplined approach paves the path toward achieving peak professional efficacy and sustained financial success in your future endeavors.

FAQ

What is due diligence in real estate?

Due diligence in real estate is a comprehensive and systematic process to evaluate a property investment’s risks and opportunities. It includes an analysis of legal, financial, physical, and compliance aspects to ensure that the potential acquisition aligns with your investment strategy and risk tolerance.

How long is the due diligence period in real estate transactions?

The due diligence period in real estate transactions typically ranges from 30 to 90 days, depending on the complexity of the property and the terms negotiated with the seller. It may include “free look” periods granting exclusive rights to the buyer while due diligence is conducted.

What should be included in a preliminary real estate due diligence checklist?

A preliminary real estate due diligence checklist should encompass a review of essential legal documentation like title policies and property tax bills, an assessment of structural plans and recent capital expenditures, and environmental reports to identify any immediate red flags.

Why is a property inspection important during due diligence?

A property inspection is crucial as it provides a hands-on evaluation of the property’s physical condition, identifies necessary repairs or maintenance issues, and assesses common area maintenance responsibilities. It reveals conditions that may affect the investment’s value and operational costs.

What financial aspects are analyzed during real estate due diligence?

The financial analysis during real estate due diligence involves evaluating recent appraisals and insurance policies, analyzing rent rolls and tenant leases, and scrutinizing service contracts and operating expenses. This reveals the property’s financial health and potential revenue streams.

What are key legal considerations during a real estate transaction?

Key legal considerations include reviewing any pending litigation, assessing the property’s legal description, and ensuring compliance with property laws and regulations. This is vital for ascertaining the legality of the transaction and mitigating future legal risks.

How do zoning and compliance mandates affect the due diligence process?

Zoning and compliance mandates are critical in determining whether the property meets municipal regulations and can be used for the intended purposes. They involve securing permits, addressing liens and encumbrances, and verifying adherence to land-use regulations.

What are the benefits of digitizing the due diligence process?

Digitizing the due diligence process through tools like cloud-based deal management software can enhance efficiency, improve data accuracy, and provide real-time access to information, leading to more informed decisions and streamlined operations.

How do due diligence and financing applications align?

Due diligence and financing applications often align by ensuring that the due diligence findings meet lender requirements, such as environmental assessments, and streamline the approval process by addressing these elements concurrently.

Why is systematizing data important for real estate analysis?

Systematizing data ensures consistency, reliability, and accuracy in real estate analysis. Using investment software with standardized checklists can facilitate comprehensive risk assessments and support repeatable, scalable investment strategies.

How can asset managers ensure accountability and transparency?

Asset managers can ensure accountability and transparency by maintaining a clear chain of custody for due diligence documents and employing regular audits and checks. Clear responsibility assignment and documented processes build stakeholder trust and support operational integrity.